Trick Elements to Take Into Consideration When Looking For an Equity Car Loan

When considering applying for an equity lending, it is crucial to browse via different essential aspects that can dramatically influence your monetary well-being. Recognizing the kinds of equity fundings available, assessing your eligibility based on economic aspects, and thoroughly examining the loan-to-value proportion are vital first steps.

Types of Equity Loans

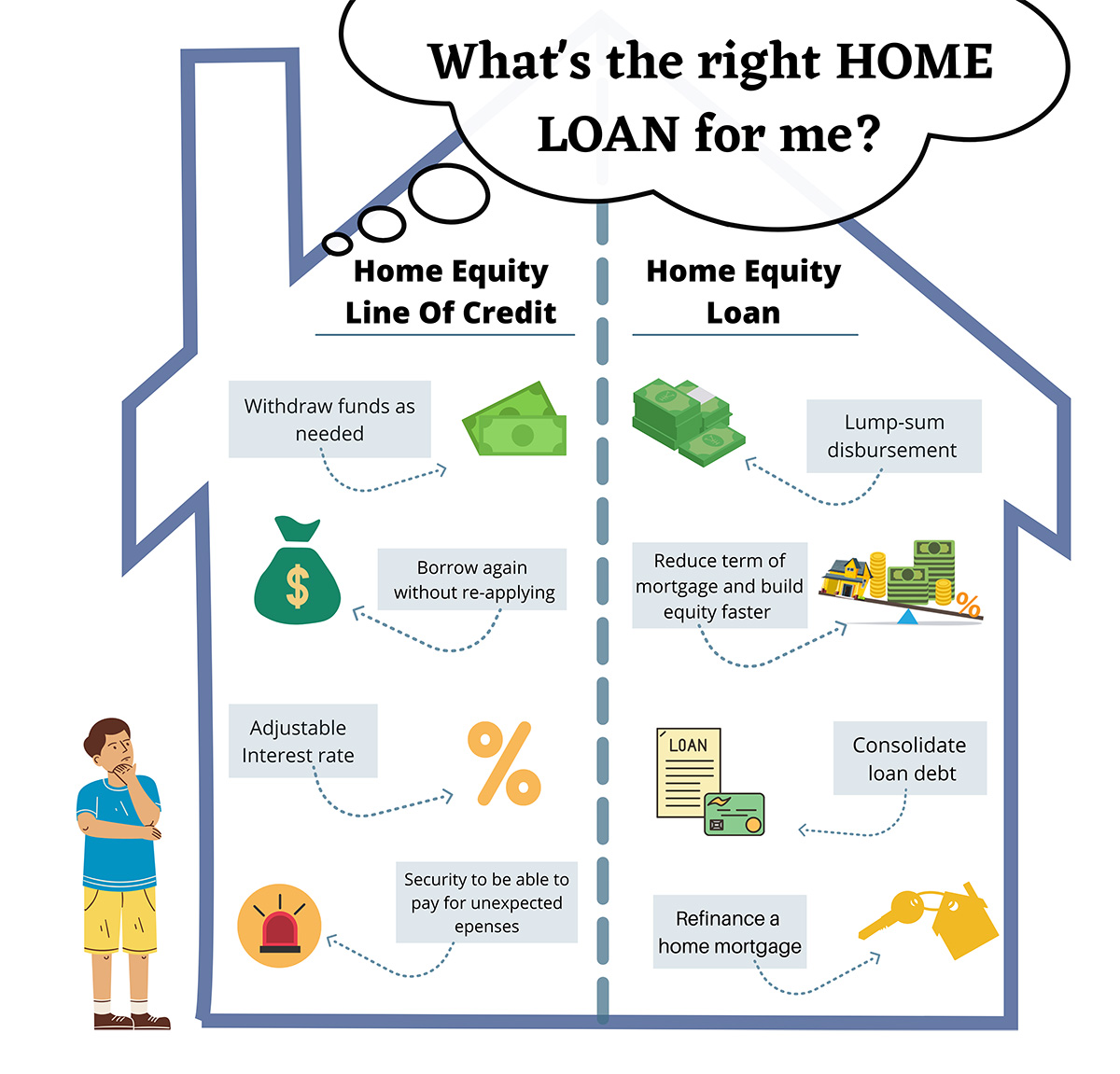

Various financial organizations offer a series of equity car loans customized to meet diverse loaning needs. One typical kind is the conventional home equity lending, where house owners can borrow a swelling amount at a fixed rate of interest, utilizing their home as collateral. This kind of funding is ideal for those who require a large sum of cash upfront for a particular purpose, such as home improvements or financial obligation loan consolidation.

Another prominent alternative is the home equity line of credit scores (HELOC), which operates much more like a credit card with a revolving credit score limit based on the equity in the home. Customers can draw funds as needed, as much as a specific limit, and just pay passion on the amount utilized. Home Equity Loans. HELOCs appropriate for continuous costs or jobs with unsure prices

In addition, there are cash-out refinances, where house owners can re-finance their existing home mortgage for a higher amount than what they owe and get the difference in money - Alpine Credits Canada. This sort of equity financing is advantageous for those seeking to make use of lower rate of interest or gain access to a big amount of cash without an additional regular monthly repayment

Equity Funding Qualification Variables

When taking into consideration qualification for an equity loan, monetary establishments commonly analyze variables such as the candidate's credit history, revenue stability, and existing debt obligations. An essential aspect is the credit history, as it mirrors the debtor's credit reliability and capacity to pay off the funding. Lenders choose a higher credit rating, usually over 620, to alleviate the danger related to loaning. Revenue stability is an additional crucial variable, showing the customer's ability to make routine lending settlements. Lenders may need evidence of regular revenue through pay stubs or income tax return. Additionally, existing financial obligation commitments play a considerable role in establishing qualification. Lenders assess the consumer's debt-to-income ratio, with reduced ratios being extra beneficial. This proportion indicates just how much of the debtor's revenue goes towards settling financial debts, affecting the loan provider's choice on funding authorization. By thoroughly analyzing these aspects, monetary organizations can determine the applicant's qualification for an equity loan and establish appropriate funding terms.

Loan-to-Value Proportion Factors To Consider

A lower LTV proportion suggests less threat for the loan provider, as the customer has even more equity in the home. Lenders typically prefer reduced LTV ratios, as they supply a higher padding in case the consumer defaults on the car loan. A higher LTV proportion, on the various other hand, suggests a riskier financial investment for the loan provider, as the consumer has less equity in the residential property. This may cause the loan provider enforcing greater rate of interest prices or stricter terms on the car loan to mitigate the boosted threat. Customers need to aim to keep their LTV proportion as low the original source as feasible to enhance their opportunities of authorization and safeguard much more desirable car loan terms.

Rate Of Interest and Charges Comparison

Upon assessing interest rates and fees, customers can make enlightened decisions concerning equity finances. Rate of interest prices can dramatically impact the overall cost of the funding, impacting month-to-month settlements and the overall quantity settled over the loan term.

Other than rate of interest, customers ought to likewise consider the various fees connected with equity finances - Alpine Credits Canada. These costs can consist of source costs, assessment costs, closing expenses, and prepayment charges. Origination charges are charged by the lender for processing the car loan, while assessment costs cover the price of examining the building's worth. Closing prices include different fees associated with completing the car loan contract. If the customer pays off the lending early., early repayment penalties may apply.

Payment Terms Analysis

Efficient assessment of repayment terms is vital for borrowers looking for an equity finance as it directly affects the finance's price and monetary end results. When analyzing payment terms, customers should carefully assess the lending's period, monthly payments, and any kind of prospective penalties for very early repayment. The financing term describes the length of time over which the consumer is expected to repay the equity financing. Much shorter finance terms typically cause higher month-to-month payments however reduced overall interest prices, while longer terms offer lower regular monthly payments but may result in paying even more interest gradually. Debtors need to consider their economic circumstance and objectives to identify the most ideal payment term for their demands. In addition, recognizing any charges for early repayment is necessary, as it can affect the versatility and cost-effectiveness of the lending. By completely evaluating settlement terms, customers can make enlightened choices that align with their monetary purposes and make certain effective car loan management.

Conclusion

In final thought, when looking for an equity financing, it is essential to think about the kind of financing offered, eligibility elements, loan-to-value proportion, rate of interest rates and charges, and repayment terms - Alpine Credits. By thoroughly evaluating these essential variables, debtors can make informed decisions that align with their financial goals and scenarios. When looking for an equity funding., it is vital to completely study and contrast alternatives to ensure the finest possible outcome.

By thoroughly examining these variables, financial establishments can identify the candidate's eligibility for an equity car loan and establish ideal loan terms. - Home Equity Loan

Interest prices can significantly influence the total expense of the lending, impacting month-to-month repayments and the complete amount settled over the lending term.Reliable examination of payment terms is crucial for consumers looking for an equity lending as it straight impacts the financing's price and economic outcomes. The lending term refers to the length of time over which the borrower is anticipated to settle the equity financing.In final thought, when applying for an equity finance, it is important to consider the kind of lending offered, qualification variables, loan-to-value ratio, interest prices and costs, and repayment terms.