Exploring the Significance of Borrowing Practices in Diverse Industries

In the complicated landscape of contemporary company, lending practices play a crucial function in forming the trajectories of varied industries. The value of exactly how resources is obtained and managed transcends mere economic deals; it intertwines with critical decision-making, market competition, and general sustainability. From traditional fields like producing to emerging areas such as modern technology and health care, the influence of lending practices reverberates deeply. Comprehending the nuances of these practices and their implications is not only an issue of monetary acumen however additionally a critical important for services browsing the elaborate web of global markets - hard money lenders in georgia atlanta.

Impact of Loaning Practices on Industries

The interplay between financing methods and numerous industries highlights the essential duty financial decisions play in shaping their trajectories. The effect of loaning methods on sectors is extensive, affecting their development, security, and total efficiency. Industries reliant on exterior financing, such as modern technology, healthcare, and realty, are particularly conscious shifts in lending methods.

For circumstances, in the innovation market, accessibility to budget friendly credit rating can sustain study and growth efforts, driving advancement and market competition. Conversely, rigorous financing standards or high-interest prices might hinder technical advancements and limit market access for start-ups. In medical care, where capital-intensive projects and devices are usual, favorable loaning terms can help with expansion and upgrade of centers, eventually enhancing person treatment. Nevertheless, restrictive lending criteria can constrict financial investments in new technologies or infrastructure renovations, influencing solution distribution.

Access to Capital and Financial Stability

Access to funding is a basic element that underpins economic security in diverse markets. Without ample capital, companies might have a hard time to introduce, broaden, or even satisfy their everyday economic commitments.

Financial stability, on the various other hand, is the outcome of a balanced economic structure that allows companies to weather unpredictabilities and sustain lasting growth. Resources works as a buffer against unexpected costs, market recessions, or competitive pressures. It likewise enables business to take chances for growth, mergings, or purchases that can enhance their market placement and profitability. Basically, access to capital is not almost obtaining funds; it has to do with making certain the monetary health and sustainability of businesses throughout different sectors.

Influence on Organization Growth Strategies

Provided the important function of capital in promoting financial security, services across varied sectors strategically straighten their financing practices to drive and sustain their expansion techniques. Accessibility to appropriate funding with numerous lending systems is a keystone for organization growth and advancement. Business often seek outside funding to promote expansions, whether through standard small business loan, equity capital financial investments, or various other economic tools customized to their particular requirements.

Lending techniques straight influence how and when a business can increase. Desirable finance terms, such as reduced rate of interest and adaptable settlement routines, can enable firms to spend in new markets, technologies, or item lines. Alternatively, restrictive financing conditions might impede growth opportunities and restrict a firm's capacity to take calculated expansion initiatives.

Difficulties Encountered in Diverse Sectors

Browsing regulatory obstacles have a peek at this site poses a substantial obstacle for organizations in diverse fields seeking to increase their my link operations. Each sector has its unique collection of challenges when it involves accessing financing. Modern technology firms may encounter difficulties due to the fast-paced nature of their sector, making it testing for standard loan providers to examine risks accurately (hard money lenders in georgia atlanta). On the various other hand, medical care companies frequently experience stringent regulations that affect their ability to secure loans for growth tasks. In addition, companies in the farming market may fight with seasonality concerns that influence their money circulation, making it more difficult to fulfill the needs established by banks. In addition, the realty market deals with obstacles connected to market volatility and changing rate of interest prices, which can make complex loaning choices. In general, the diverse industries all emulate specific regulatory, functional, and market-related barriers that require tailored loaning options to sustain their growth initiatives successfully. By comprehending these sector-specific challenges, lenders can much better resolve the special requirements of companies throughout numerous markets.

Function of Strategic Financial Administration

Final Thought

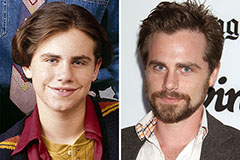

Rider Strong Then & Now!

Rider Strong Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!